Introduction

For those who’ve ever analyzed knowledge utilizing built-in t-test features, corresponding to these in R or SciPy, right here’s a query for you: have you ever ever adjusted the default setting for the choice speculation? In case your reply is not any—or for those who’re not even certain what this implies—then this weblog put up is for you!

The choice speculation parameter, generally known as “one-tailed” versus “two-tailed” in statistics, defines the anticipated path of the distinction between management and therapy teams. In a two-tailed check, we assess whether or not there may be any distinction in imply values between the teams, with out specifying a path. A one-tailed check, then again, posits a selected path—whether or not the management group’s imply is both lower than or better than that of the therapy group.

Selecting between one- and two-tailed hypotheses may seem to be a minor element, but it surely impacts each stage of A/B testing: from check planning to Data Analysis and outcomes interpretation. This text builds a theoretical basis on why the speculation path issues and explores the professionals and cons of every method.

One-tailed vs. two-tailed speculation testing: Understanding the distinction

To know the significance of selecting between one-tailed and two-tailed hypotheses, let’s briefly assessment the fundamentals of the t-test, the generally used methodology in A/B testing. Like different Hypothesis Testing strategies, the t-test begins with a conservative assumption: there is no such thing as a distinction between the 2 teams (the null speculation). Provided that we discover robust proof in opposition to this assumption can we reject the null speculation and conclude that the therapy has had an impact.

However what qualifies as “robust proof”? To that finish, a rejection area is set underneath the null speculation and all outcomes that fall inside this area are deemed so unlikely that we take them as proof in opposition to the feasibility of the null speculation. The dimensions of this rejection area relies on a predetermined chance, referred to as alpha (α), which represents the chance of incorrectly rejecting the null speculation.

What does this need to do with the path of the choice speculation? Fairly a bit, truly. Whereas the alpha stage determines the scale of the rejection area, the choice speculation dictates its placement. In a one-tailed check, the place we hypothesize a selected path of distinction, the rejection area is located in just one tail of the distribution. For a hypothesized optimistic impact (e..g., that the therapy group imply is larger than the management group imply), the rejection area would lie in the appropriate tail, making a right-tailed check. Conversely, if we hypothesize a damaging impact (e.g., that the therapy group imply is lower than the management group imply), the rejection area could be positioned within the left tail, leading to a left-tailed check.

In distinction, a two-tailed check permits for the detection of a distinction in both path, so the rejection area is break up between each tails of the distribution. This accommodates the potential of observing excessive values in both path, whether or not the impact is optimistic or damaging.

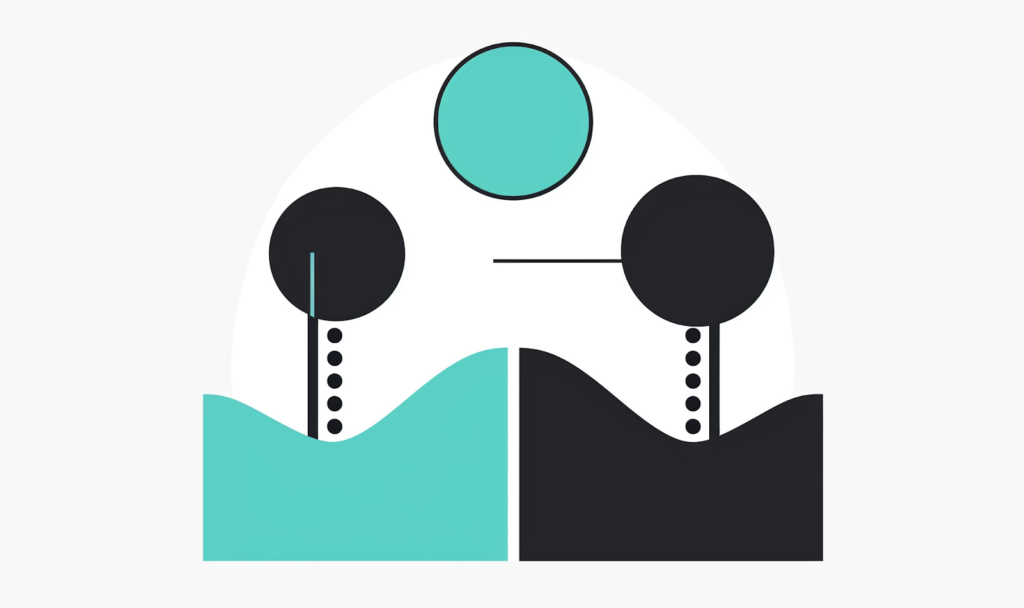

To construct instinct, let’s visualize how the rejection areas seem underneath the completely different hypotheses. Recall that in line with the null speculation, the distinction between the 2 teams ought to focus on zero. Due to the central restrict theorem, we additionally know this distribution approximates a standard distribution. Consequently, the rejection areas similar to the completely different various speculation appear to be that:

Why does it make a distinction?

The selection of path for the choice speculation impacts your entire A/B testing course of, beginning with the planning part—particularly, in figuring out the pattern dimension. Pattern dimension is calculated based mostly on the specified energy of the check, which is the chance of detecting a real distinction between the 2 teams when one exists. To compute energy, we look at the world underneath the choice speculation that corresponds to the rejection area (since energy displays the flexibility to reject the null speculation when the choice speculation is true).

Because the path of the speculation impacts the scale of this rejection area, energy is usually decrease for a two-tailed speculation. That is as a result of rejection area being divided throughout each tails, making it tougher to detect an impact in anyone path. The next graph illustrates the comparability between the 2 kinds of hypotheses. Word that the purple space is bigger for the one-tailed speculation, in comparison with the two-tailed speculation:

In observe, to keep up the specified energy stage, we compensate for the lowered energy of a two-tailed speculation by growing the pattern dimension (Growing pattern dimension raises energy, although the mechanics of this is usually a matter for a separate article). Thus, the selection between one- and two-tailed hypotheses immediately influences the required pattern dimension to your check.

Past the planning part, the selection of different speculation immediately impacts the evaluation and interpretation of outcomes. There are instances the place a check could attain significance with a one-tailed method however not with a two-tailed one, and vice versa. Reviewing the earlier graph may help illustrate this: for instance, a consequence within the left tail may be vital underneath a two-tailed speculation however not underneath a proper one-tailed speculation. Conversely, sure outcomes may fall throughout the rejection area of a proper one-tailed check however lie outdoors the rejection space in a two-tailed check.

Tips on how to resolve between a one-tailed and two-tailed speculation

Let’s begin with the underside line: there’s no absolute proper or mistaken alternative right here. Each approaches are legitimate, and the first consideration needs to be your particular enterprise wants. That can assist you resolve which possibility most accurately fits your organization, we’ll define the important thing execs and cons of every.

At first look, a one-tailed various could seem like the clear alternative, because it typically aligns higher with enterprise aims. In business purposes, the main target is often on enhancing particular metrics quite than exploring a therapy’s affect in each instructions. That is particularly related in A/B testing, the place the objective is commonly to optimize conversion charges or improve income. If the therapy doesn’t result in a big enchancment the examined change gained’t be carried out.

Past this conceptual benefit, we’ve already talked about one key good thing about a one-tailed speculation: it requires a smaller pattern dimension. Thus, selecting a one-tailed various can save each time and sources. As an example this benefit, the next graphs present the required pattern sizes for one- and two-tailed hypotheses with completely different energy ranges (alpha is ready at 5%).

On this context, the choice between one- and two-tailed hypotheses turns into notably vital in sequential testing—a technique that enables for ongoing knowledge evaluation with out inflating the alpha stage. Right here, deciding on a one-tailed check can considerably scale back the period of the check, enabling sooner decision-making, which is particularly invaluable in dynamic enterprise environments the place immediate responses are important.

Nonetheless, don’t be too fast to dismiss the two-tailed speculation! It has its personal benefits. In some enterprise contexts, the flexibility to detect “damaging vital outcomes” is a significant profit. As one consumer as soon as shared, he most popular damaging vital outcomes over inconclusive ones as a result of they provide invaluable studying alternatives. Even when the result wasn’t as anticipated, he might conclude that the therapy had a damaging impact and achieve insights into the product.

One other good thing about two-tailed exams is their easy interpretation utilizing confidence intervals (CIs). In two-tailed exams, a CI that doesn’t embody zero immediately signifies significance, making it simpler for practitioners to interpret outcomes at a look. This readability is especially interesting since CIs are broadly utilized in A/B testing platforms. Conversely, with one-tailed exams, a big consequence may nonetheless embody zero within the CI, probably resulting in confusion or distrust within the findings. Though one-sided confidence intervals could be employed with one-tailed exams, this observe is much less frequent.

Conclusions

By adjusting a single parameter, you’ll be able to considerably affect your A/B testing: particularly, the pattern dimension you might want to gather and the interpretation of the outcomes. When deciding between one- and two-tailed hypotheses, contemplate elements such because the obtainable pattern dimension, the benefits of detecting damaging results, and the comfort of aligning confidence intervals (CIs) with speculation testing. Finally, this resolution needs to be made thoughtfully, taking into consideration what most closely fits your corporation wants.

(Word: all the photographs on this put up have been created by the writer)