DATA STORIES | FINANCE | KNIME ANALYTICS PLATFORM

That is a part of a sequence of articles to indicate you options to widespread finance duties associated to monetary planning, accounting, tax calculations, and auditing issues all applied with the low-code KNIME Analytics Platform.

Bank card fraud detection stands out as an ongoing problem to precisely establish all new fraud patterns. Datasets containing fraud examples are uncommon, and once they do exist, they typically embody a restricted variety of outdated circumstances. This shortage makes fraud detection significantly difficult, because it should repeatedly adapt to the evolving ways of fraudsters.

There are two approaches to fraud detection:

- Basic machine studying based mostly predictions, when your dataset accommodates sufficient fraud examples

- Outlier detection based mostly strategies, when your dataset doesn’t include a enough variety of fraud examples

The dataset that we are going to use accommodates a small p.c of fraudulent transactions. Primarily based on these examples, we’ll implement the basic machine-learning based mostly strategy for fraud detection for this text.

Within the subsequent couple articles, we’ll present the best way to implement fraud detection algorithms utilizing outlier detection based mostly strategies.

No matter your knowledge scenario is, this sequence will present you the way KNIME Analytics Platform presents a low-code answer for this drawback. It may possibly allow monetary groups to automate knowledge consumption from numerous sources and leverage superior analytics to detect fraudulent transactions, with out the necessity for a coding background.

On this article on fraud detection, you’ll discover ways to use the Random Forest supervised studying algorithm to assist establish fraudulent transactions. Watch the video for an summary.

Bank card transactions can basically be divided into two classes: reputable and fraudulent. The duty at hand is to precisely establish and flag fraudulent transactions to make sure that a small minority of flagged transactions are reputable.

The method of fraud detection typically includes a number of handbook and automatic steps to investigate transaction patterns, buyer habits, and different related components. For our functions, we’ll solely concentrate on the automation a part of detection by coaching a mannequin on a labeled dataset and making use of it to a brand new transaction to simulate incoming knowledge from an out of doors knowledge supply.

We use a preferred dataset out there from Kaggle referred to as Credit Card Fraud Detection. This dataset consists of actual, anonymized transactions made by bank cards in September 2013 by European cardholders. It consists of 284,807 transactions over two days, containing 492 fraudulent transactions. The dataset represents a extreme class imbalance between the ‘good’ (0) and ‘frauds’ (1), the place ‘frauds’ account for less than 0.172% of the information.

The dataset accommodates 31 columns:

A key characteristic wanted for our coaching is ‘Class’ as we’d like labeled knowledge for a supervised coaching algorithm.

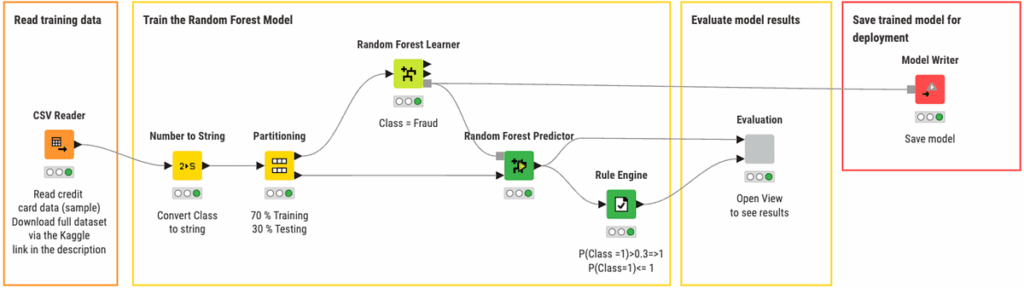

The method for creating our classification mannequin follows the steps under. Even when there may be knowledge coming from a number of sources, the general course of doesn’t change:

- Create/import a labeled coaching dataset

- Partition the information

- Practice the mannequin

- Consider mannequin efficiency

- Import the brand new, unseen transactions

- Deploy the mannequin and feed the brand new transactions in

- Notify if any fraudulent transactions are labeled.

All workflows used on this article can be found publicly and free to obtain on the KNIME Neighborhood Hub. You will discover the workflows on the KNIME for Finance area below Fraud Detection within the Random Forest section.

The primary workflow covers coaching our mannequin. You’ll be able to view and obtain the coaching workflow Random Forest Model Training from the KNIME Neighborhood Hub.