Synthetic intelligence is reworking how 10 million QuickBooks prospects handle their funds. Companies utilizing QuickBooks‘ AI-powered options receives a commission five days faster. They are also 10% extra prone to obtain full fee on overdue invoices. These capabilities free enterprise homeowners from tedious bookkeeping duties, permitting them to deal with development and technique.

But it surely doesn’t cease at built-in AI. For those who’re seeking to reduce much more guide work, specialised integrations like Nanonets might help. It provides one other layer of AI-powered automation to your QuickBooks workflows, enabling you to automate info seize, approval routing, and bill posting.

The end result? You get a contemporary monetary stack that after required a devoted back-office workforce to handle. Now, enterprises can streamline complicated monetary operations, cut back guide errors, and provides their groups extra time for strategic tasks with out overhauling their present programs or retraining total departments.

QuickBooks native AI: options defined

Intuit Help features as an AI-powered monetary assistant in QuickBooks On-line, studying from your corporation patterns to automate duties and supply insights. Via a centralized enterprise feed, it displays your monetary knowledge and suggests actions to enhance your operations.

This is how Intuit Help and different native QuickBooks AI options work:

- Bill reminders: Create customized bill reminders that adapt to every shopper relationship. You’ll be able to customise the tone and elegance of those communications whereas letting the AI decide optimum sending occasions based mostly on fee patterns.

- Knowledge extraction: Convert photographs of receipts, invoices, and even handwritten notes into QuickBooks transactions. The AI extracts quantities, dates, and line gadgets and mechanically populates the related fields for evaluate.

- Transaction categorization: When categorizing transactions, the AI gives explanations for its solutions, displaying you why it selected particular classes. This transparency helps you make knowledgeable choices about accepting or adjusting its suggestions.

- Enterprise feed and motion plans: The AI-driven enterprise feed displays your monetary knowledge and suggests particular actions. It could generate invoices from conversations and paperwork, warn you about fee points, and suggest steps to enhance your monetary operations.

- Proactive money movement administration: The system analyzes your monetary patterns to foretell potential money movement points earlier than they happen. It recommends fee strategies prone to lead to sooner assortment and might join you with lending choices when it identifies potential shortfalls.

- Matching and reconciliation: The AI mechanically matches incoming transactions with present payments, invoices, or receipts in your system, serving to forestall duplicates and streamlining the reconciliation course of.

Whereas Intuit Help streamlines many monetary workflows, complicated enterprise necessities typically demand extra capabilities. As an illustration, organizations processing tons of of non-standard invoices every day might have extra specialised doc processing instruments.

Excessive-volume transaction matching and receipt seize at scale may require purpose-built AI options to keep up accuracy and effectivity. You will have to mix QuickBooks’ native options with specialised AI instruments like Nanonets to construct a extra complete monetary automation technique.

Find out how to broaden QuickBooks’ AI capabilities?

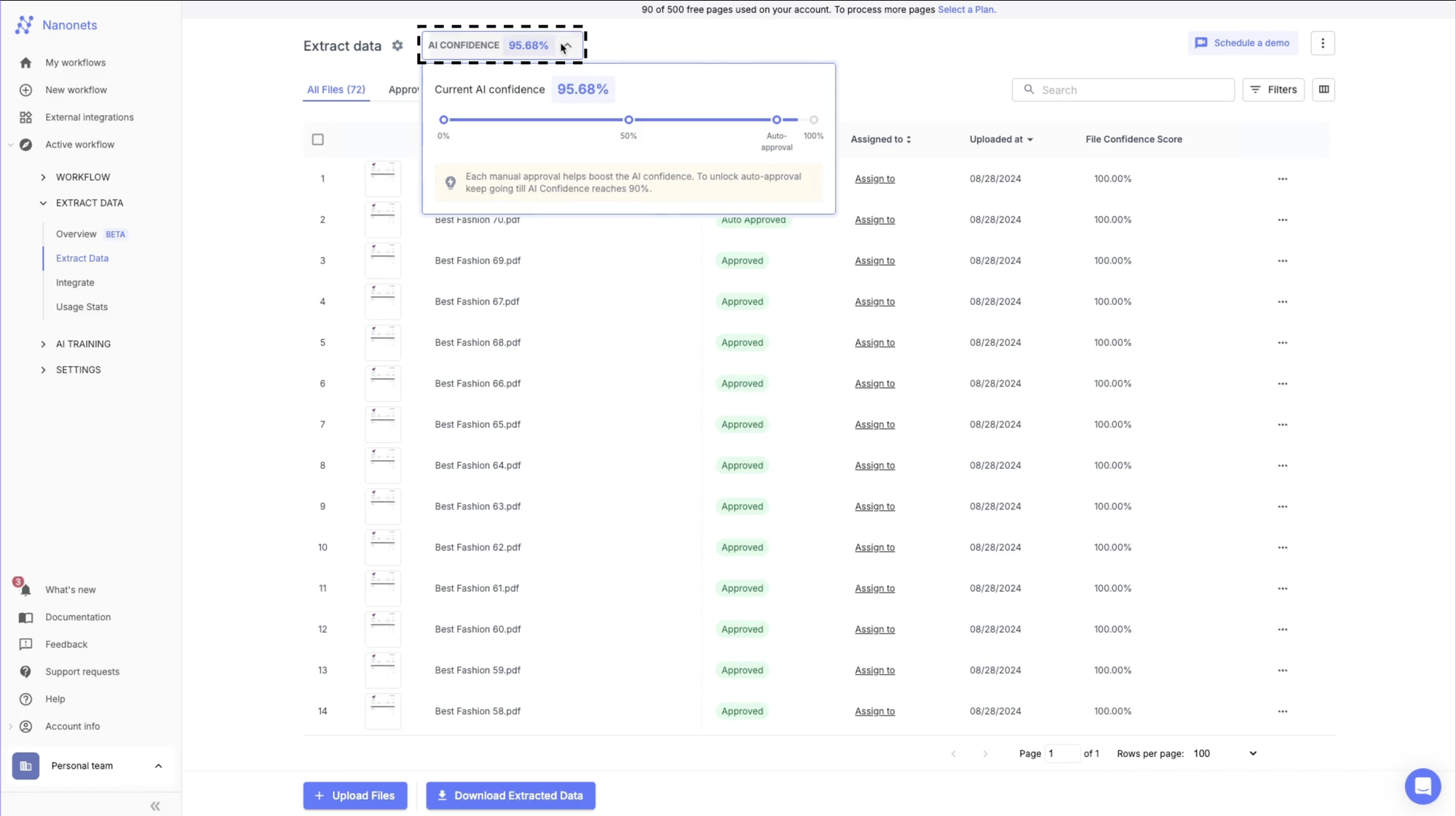

Nanonets is an clever doc processing platform that integrates instantly with QuickBooks. This mix enhances its AI options, significantly for complicated doc processing and approval workflows. You’d have the ability to deal with paperwork in any format or language, with the AI studying and bettering because it processes extra of your particular doc sorts.

Let me present you ways Nanonets might help broaden your QuickBooks AI capabilities:

1. Automated doc processing

Getting invoices and buy orders into your accounting system is commonly the primary bottleneck. Many companies waste hours manually downloading attachments from emails, sorting by means of totally different codecs, and typing knowledge into QuickBooks.

Nanonets solves this by means of automated doc consumption channels:

- Ahead invoices instantly from electronic mail

- Join your ERP system for automated import

- Add paperwork by means of the online interface

- Monitor particular folders for brand spanking new paperwork

The system processes these paperwork utilizing AI-powered OCR to:

- Extract key fields like bill numbers and quantities

- Seize line merchandise particulars mechanically

- Convert dates into standardized codecs

- Current knowledge in each type and tabular views

For instance, when a vendor emails an bill, merely ahead it to your devoted Nanonets electronic mail handle. You’ll be able to see the identical within the GIF above. The system mechanically processes the doc and extracts the info, turning what was once a 5-minute guide process right into a 30-second automated workflow. For a enterprise processing 100 invoices month-to-month, this might save over hours of guide knowledge entry time.

2. Clever PO matching

Buy order matching is usually a tedious course of the place AP groups manually cross-reference invoices towards POs and receiving studies. This typically results in fee delays, duplicate funds, or overpayments when discrepancies go unnoticed.

Nanonets automates this verification course of by means of clever three-way matching:

- Mechanically pulls matching PO knowledge from QuickBooks

- Validates bill totals towards PO quantities

- Matches particular person line gadgets for amount and value

- Verifies vendor particulars towards QuickBooks information

- Flags any discrepancies for evaluate

The system performs particular validations and clearly flags points when:

- Bill quantities do not match PO values (e.g., $2,106 bill vs $3,138 PO)

- Line merchandise portions differ from ordered portions

- Transport portions do not match ordered portions

- Costs have modified from the unique PO

For instance, when processing an bill, the system mechanically pulls the corresponding PO from QuickBooks and compares every line merchandise. If an bill reveals a amount of two items whereas the PO specified 1 unit, it instantly flags this discrepancy. The AP workforce can then evaluate simply these flagged gadgets as a substitute of manually evaluating each element, turning what was usually a 15-20 minute verification course of into a fast 2-minute exception evaluate.

3. Automated QuickBooks export

After bill processing and validation, finance groups typically face one other time-consuming process: manually creating payments in QuickBooks. This course of usually includes switching between programs, re-entering knowledge, and attaching paperwork. It opens up alternatives for errors and duplicates.

Nanonets streamlines this by means of direct QuickBooks integration:

- Select between account-based or item-based payments

- Create direct expense entries

- Choose particular AP accounts for posting

- Map bill fields to QuickBooks fields

- Deal with stock merchandise monitoring

The system provides versatile export controls:

- Export upon approval or after particular validations

- Break up exports by web page or total doc

- Embody attachments mechanically

- Sync vendor lists in real-time

- Observe export standing and errors

As an illustration, when an bill is authorised, Nanonets mechanically creates a invoice in QuickBooks with all the proper categorizations, line gadgets, and attachments. The system even maps stock gadgets appropriately, updating portions and prices. Invoices can movement mechanically into QuickBooks in seconds, with validation checks making certain accuracy at each step.

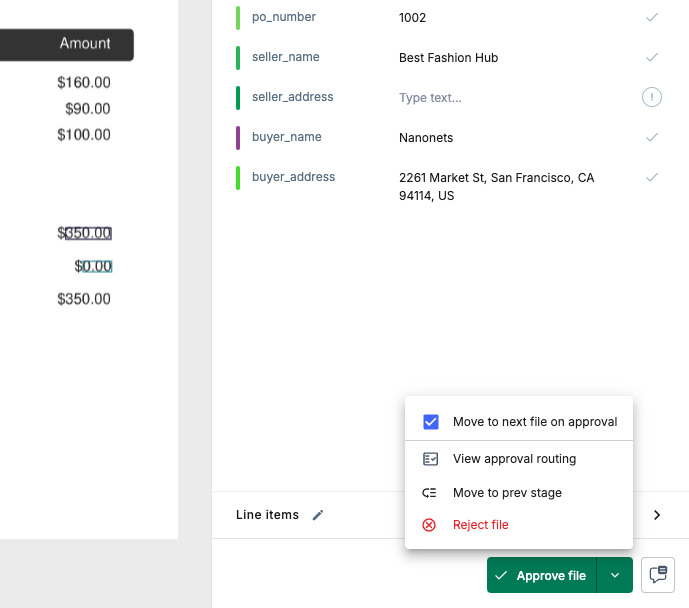

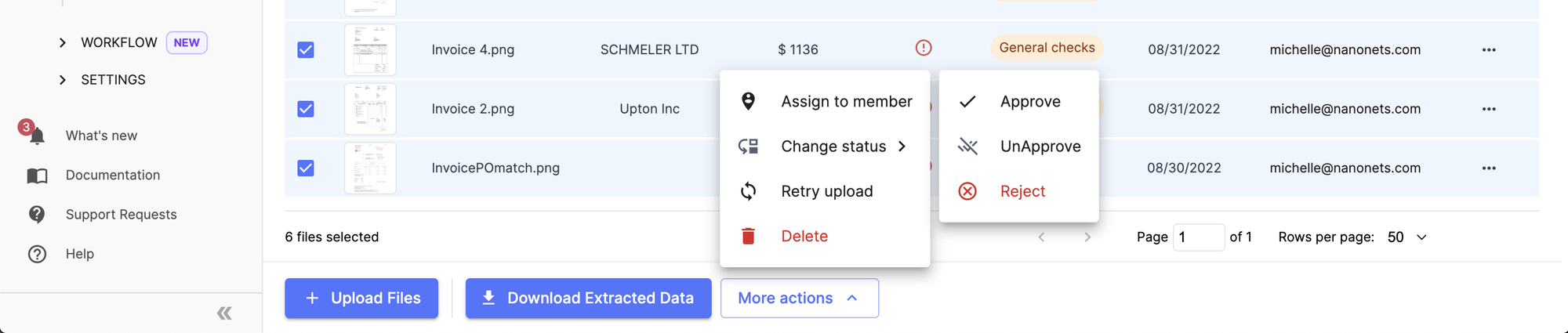

4. Seamless approval movement

Companies typically battle with bill approvals getting caught in electronic mail chains or misplaced in paper trails. With no structured workflow, monitoring who must approve what and when turns into a guessing recreation, resulting in fee delays and vendor frustration.

Nanonets buildings your approval course of by means of:

- Customizable approval workflows based mostly on quantity, vendor, or division

- Automated reviewer task

- Actual-time validation alerts

- Full audit path monitoring

The system automates communication by:

- Sending electronic mail alerts for pending approvals

- Notifying reviewers about validation failures

- Enabling feedback and workforce tagging

- Monitoring all communication in a single place

- Sustaining dialog historical past for audit functions

Say when an bill fails PO matching, Nanonets mechanically routes it to the suitable reviewer with all related particulars and comparability knowledge highlighted. Reviewers can remark, tag workforce members, and observe adjustments throughout the one interface. You will not have to fret about scattered approval processes anymore.

5. Touchless knowledge enhancements

Making ready bill and buy order knowledge for export can require greater than easy extraction. Groups typically must standardize codecs, apply enterprise guidelines, and guarantee all crucial fields are appropriate earlier than pushing information into QuickBooks. With out automation, this step turns into a repetitive guide checkpoint that slows down your workflow and will increase the danger of errors.

Nanonets addresses this with versatile knowledge actions and enhancement steps:

- Mechanically codecs dates into ISO requirements

- Cleans and converts financial fields to match accounting necessities

- Performs customized lookups, corresponding to verifying PO numbers in QuickBooks earlier than export

- Creates conditional logic for subject validation, corresponding to flagging lacking required values or checking for duplicates

- Helps user-defined scripts for complicated enterprise guidelines

For instance, if you happen to obtain invoices from worldwide distributors with assorted date codecs and currencies, Nanonets can convert dates and quantities into your most well-liked QuickBooks format as a part of the workflow. If an bill doesn’t match an present PO, the system flags it for evaluate mechanically. These enhancements save guide effort and guarantee knowledge integrity throughout your monetary information.

Every of those steps might be adjusted based mostly in your particular necessities. The system continues to be taught out of your paperwork and processes, bettering accuracy over time by means of machine studying. Finance groups can deal with reviewing exceptions and strategic evaluation whereas the AI handles routine processing.

Actual-world advantages and success tales

Combining QuickBooks’ native AI with specialised doc processing instruments delivers tangible enhancements to monetary operations. Organizations implementing this built-in strategy report vital reductions in guide knowledge entry, fewer errors of their monetary knowledge, sooner processing cycles, and the power to scale operations with out proportionally growing headcount.

These effectivity positive factors translate on to bottom-line advantages: decrease processing prices, higher money movement administration, and extra time for strategic monetary actions.

Listed here are examples of how totally different companies have applied this strategy and the outcomes they’ve achieved:

1. Comfortable Jewelers: 90% discount in doc processing time

Happy Jewelers, a family-owned enterprise with a number of jewellery shops throughout California, Chicago, and New York, struggled with bill administration as they expanded.

🗨️

After implementing Nanonets with their present QuickBooks system, Comfortable Jewelers automated their doc consumption by means of electronic mail integration and bill classification. The system captured key info like vendor identify, bill quantity, date, and due date whereas mechanically organizing paperwork by vendor. This implementation allowed their finance workforce to course of 50% extra invoices on the similar time with out extra employees.

2. Professional Companions Wealth: 40% time financial savings over conventional OCR

Professional Companions Wealth, an accounting and wealth administration agency headquartered in Missouri, confronted challenges with their present doc processing system. Regardless of utilizing automation software program, their workforce spent vital time correcting bill knowledge entries manually. Their straight-through processing fee was very low, with practically each bill requiring evaluate or modifying.

🗨️

“Nanonets is the long-term resolution for firms seeking to develop. We’re seeing a significant distinction in accuracy, as Nanonets gives >95% accuracy which has helped reduce down our processing time by ~50%.” ~ Kale Flaspohler, Monetary Advisor at Professional Companions Wealth

After implementing Nanonets with QuickBooks, Professional Companions Wealth achieved:

- 95% knowledge extraction accuracy (up from 80% with their earlier device)

- Over 80% straight-through processing fee

- 40% time financial savings in comparison with conventional OCR instruments

- The power to scale their enterprise by taking up new shoppers

On account of these enhancements, Professional Companions Wealth shifted from manually validating each bill to primarily performing spot checks.

Last ideas

The mix of QuickBooks’ native AI capabilities and specialised doc processing instruments creates a strong monetary administration ecosystem that works for companies of all sizes.

Whether or not you are fighting excessive bill volumes like Comfortable Jewelers or want larger accuracy like Professional Companions Wealth, this built-in strategy delivers measurable enhancements in effectivity and accuracy.

Able to see how AI-enhanced QuickBooks may remodel your monetary workflows? Schedule a demo with us to discover a personalized resolution tailor-made to your particular enterprise necessities.