The Indian motor insurance coverage market is presently valued at round $13.19 billion and is projected to achieve $21.48 billion by 2030. Whereas the trade continues to develop steadily, regulators have additionally issued sturdy mandates to insurers to enhance their turnaround occasions and supply higher buyer experiences.

For certainly one of India’s greatest non-public insurers, which prided itself on a excessive declare settlement ratio, this meant discovering new methods to streamline its back-office processes and scale back guide errors. However it wasn’t simple. They course of greater than 350,000 instances yearly— every file incorporates over 10 forms of paperwork, various codecs and constructions, 30+ line gadgets, and a number of ingestion channels. That they had a backend crew of 40 information entry clerks and car specialists manually inputting data from restore estimates, invoices, and supporting paperwork into their declare administration system

This inefficient, unscalable workflow could not meet the regulator’s turnaround time mandates, forcing a re-evaluation of their motor declare processing method. Let’s discover how they went about it.

What modified in motor declare processing in 2024

In June 2024, IRDAI, the Indian insurance coverage regulator, issued new tips aimed toward bettering motor insurance coverage declare settlement processes.

The important thing adjustments included:

- No arbitrary rejection of motor insurance coverage claims on account of lack of paperwork — insurers should request all required paperwork upfront throughout coverage issuance

- Insurers should allocate a surveyor inside 24 hours, get hold of the survey report inside 15 days, and resolve on the declare inside 7 days of receiving the survey report

- Necessary buyer data sheet (CIS) to offer clear coverage particulars and claims course of

- Restrictions on coverage cancellation, permitting it solely in instances of confirmed fraud with 7-day discover

- Requirement to reveal the insured declared worth (IDV) calculation technique

Because the insurer’s enterprise grew quickly, these regulatory challenges made dealing with near 30,000 claims month-to-month turned greater than only a processing problem. It uncovered basic operational constraints that threatened their skill to scale and ship worth to prospects.

Let’s discover how these adjustments affected the insurer’s enterprise:

- Couldn’t scale their operations with out including head depend.

- Unable to satisfy IRDAI’s necessary declare settlement timelines – risking regulatory penalties for violations

- Getting poor critiques and detrimental suggestions from prospects

- Car specialists spending priceless time on information entry as an alternative of value evaluation

These challenges made it not possible for them to justify premium will increase based mostly on precise declare prices and danger profiles.

Why guide declare processing was sophisticated

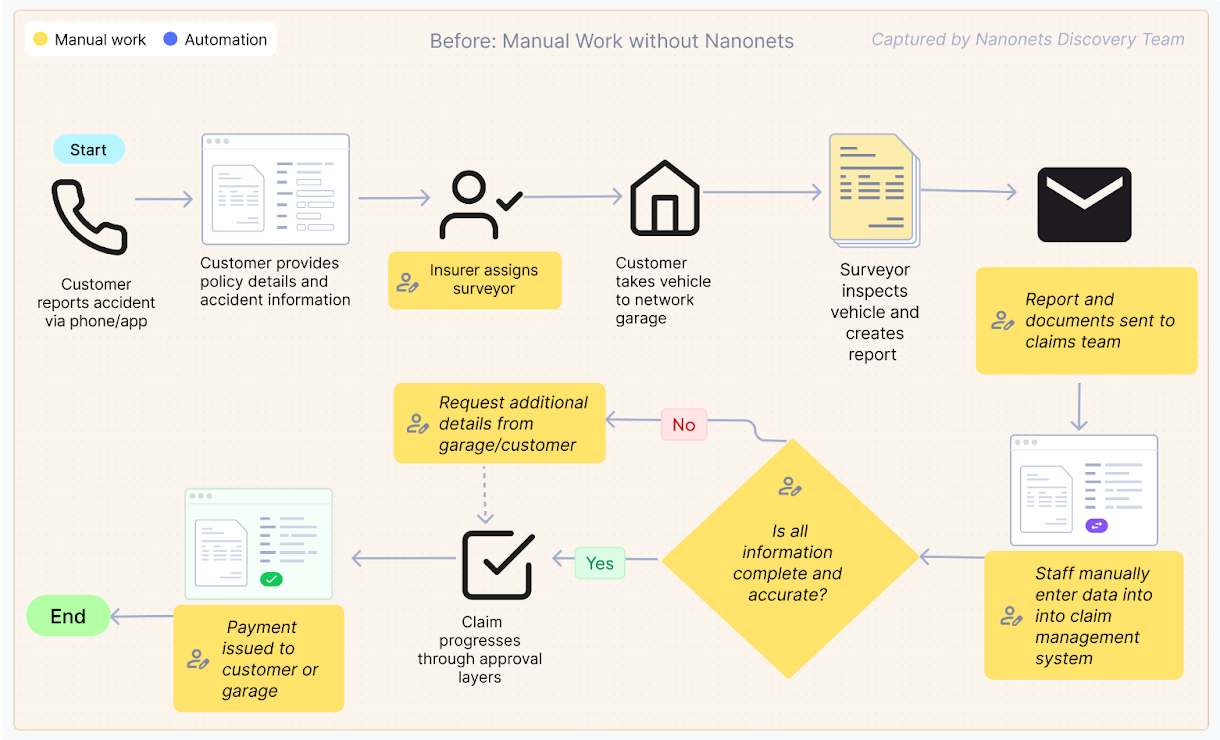

Let’s first try to perceive what the insurer’s declare processing workflow used to appear to be.

1. When an accident happens, the client can both name up the insurer’s toll-free quantity to register the declare or use their proprietary cell app to finish the declare type.

2. Throughout this, prospects can be requested to share coverage quantity, car particulars (make, mannequin, registration quantity, and so forth.), accident or harm particulars, and police report (if relevant).

3. The client is then requested to take the car to one of many insurer’s approved community garages for inspection and restore. They should submit the required paperwork to the surveyor assigned by the insurer.

4. The surveyor would examine the car and put together a report, which might then be submitted to the claims crew.

5. The claims crew would then assess the surveyor’s report and the paperwork submitted, evaluating elements like car identification, half numbers, unit pricing, and general declare validity.

6. After the evaluation, the crew would manually enter the related particulars into the claims administration system.

7. The declare would then undergo a number of layers of approval earlier than the settlement quantity could possibly be disbursed to the client or the storage (in case, the client opts for cashless mode)

The backend crew, consisting of 40 information entry clerks and car specialists, manually inputs all the important thing particulars from the declare file into their proprietary declare administration system. This included capturing data from totally different doc varieties, resembling estimates, invoices, registration certificates, driving licenses, and extra.

Keep in mind that these paperwork are issued by totally different sources. As an illustration, a driver’s license issued in a single state could not observe the identical format because the one issued in one other state.

The crew would meticulously overview every line merchandise and half quantity to make sure accuracy earlier than the declare could possibly be additional processed and accredited. One other problem was the inconsistent naming conventions for elements throughout totally different garages and producers – the identical part would have totally different names relying on who submitted the doc.

As an illustration, what seems as a entrance bumper on one estimate is perhaps listed as a bumper cowl on one other. Equally, the part referred to as a boot in paperwork from UK and German producers would present up as a deck or trunk in producers from different international locations. With no standardized database, these variations created fixed confusion.

Mismatches in car identification or half numbers, incorrect unit pricing, or lacking paperwork would trigger the declare to return to evaluation. This complete course of may take wherever from 15 to 30 days, falling in need of the brand new regulatory timelines.

When claims prolonged past IRDAI’s mandated settlement durations, the implications have been each regulatory and business. On the regulatory aspect, the insurer confronted financial penalties and present trigger notices. Commercially, these delays broken their market repute and prompted formal buyer complaints, which require important time and sources to resolve. The prolonged processing drove up operational prices, as claims wanted further touchpoints and extended dealing with, additionally leading to buyer dissatisfaction.

The insurer shortly realized that this inefficient workflow couldn’t sustain with the rising enterprise calls for and the stricter regulatory necessities.

How the insurer automated its declare processing workflow

The insurer knew they needed to step up their recreation. A number of the opponents, particularly the totally digital-first insurers, had already began rolling out zero-touch declare processing.

They explored a number of OCR options, however shortly realized such instruments received’t lower it. These instruments have been closely depending on format and construction consistency. This led to formatting errors and inconsistent extraction, and extra guide interventions. And to make issues worse, they might solely feed sure doc codecs into the system, leaving a good portion of the declare information untouched.

The insurer discovered they wanted a format-agnostic resolution that might deal with all doc varieties, extract the appropriate data, and combine seamlessly into their present claims administration system. After evaluating a number of AI-powered doc processing platforms, they selected to go together with Nanonets’ Clever Doc Processing (IDP) resolution.

Right here’s why:

- Simplicity of the PDF extraction workflows

- Line merchandise extraction accuracy

- API and system integration capabilities

- Capacity to deal with all doc codecs, together with handwritten and semi-structured paperwork

- Multi-lingual capabilities

We at Nanonets labored with the insurer to create a tailor-made doc processing resolution that match their particular claims workflow. The implementation centered on incremental enhancements fairly than an entire in a single day transformation.

The crew started by tackling essentially the most important paperwork within the claims course of: estimates, invoices, and pre-invoices. These paperwork include the important details about car damages, required repairs, and related prices.

The preliminary part centered on:

- Configuring OCR fashions to extract line gadgets from restore invoices and estimates

- Creating techniques to differentiate elements from labor prices

- Constructing validation guidelines to flag potential information inconsistencies

- Integrating with the insurer’s utility on their proprietary declare administration system by way of API

The workflow was simple. Right here’s what it appeared like:

- Declare initiation and doc assortment: When a declare occasion happens, policyholders provoke the declare type via the insurer’s consumer interface or customer support. The declare type collects primary particulars together with important paperwork together with restore estimates, invoices, and supporting documentation.

- Doc submission to Nanonets: As soon as uploaded to the insurer’s system, these paperwork are robotically routed to Nanonets by way of API integration. Beforehand, a crew of 40 backend staff would manually overview and enter data from these paperwork into their system.

- Clever doc processing: Nanonets processes the paperwork utilizing specialised fashions to:

- Classify every doc sort robotically (bill, estimate, registration certificates, and so forth.) and route it to the appropriate information extraction mannequin

- The mannequin extracts structured information from each standardized and non-standardized codecs

- Learn and set up line gadgets from restore estimates and invoices

- Distinguish between elements and labor expenses utilizing key phrase recognition

- Components database validation: Extracted half data is validated towards a complete elements grasp database that:

- Standardizes various half names throughout totally different garages (bumper vs. cowl)

- Identifies potential little one half replacements (resembling door pores and skin versus complete door meeting)

- Categorizes supplies (plastic, glass, metallic) for correct value evaluation

- Knowledge integration: The extracted and validated data is distributed again into the insurer’s system as a customized JSON file, robotically populating the suitable fields within the declare evaluation interface.

- Exception-based overview: The backend crew critiques the populated information, focusing solely on flagged exceptions or uncommon instances.

- Approval and settlement: Claims that go validation proceed to approval and settlement, with considerably lowered guide intervention.

The preliminary implementation centered on core paperwork (estimates, invoices, and pre-invoices), with plans to broaden to supporting paperwork like driving licenses, registration certificates, journey permits, health certificates, and tax paperwork.

The affect of automating insurance coverage claims processing

It’s been solely three months for the reason that implementation, however the brand new workflow has already proven promising indicators for the insurer.

Let’s check out the affect:

- 1.5 million pages processed in three months, nearly double the earlier quantity of 760,000 pages

- Standardized naming for about 600 widespread elements that cowl 90% of claims

- Systematically establish alternatives for little one half replacements (like a door pores and skin at ₹5,000 versus a complete door meeting at ₹20,000) – saves a ton of value

- Allow workers to spend much less time on information entry and extra on doc overview and exception dealing with

- Simpler to satisfy IRDAI’s regulatory timelines, which require declare choices inside 7 days of receiving the survey report

- Customized JSON integration permits seamless information stream between Nanonets and the insurer’s declare administration system

Proper now, the main target is on the core paperwork — estimates, invoices, and pre-invoices — because the crew will get comfy with the brand new course of. After that, we’ll cowl the remaining doc varieties like driving licenses and registration certificates within the subsequent part — this could lower guide work by 50%.

What’s subsequent

The subsequent part will broaden doc processing to incorporate supporting paperwork like driving licenses, registration certificates, journey permits, health certificates, and tax paperwork. Moreover, we’re working with the identical insurer, automating their medical claims processing workflow.

In case your insurance coverage firm is struggling to take care of mounting paperwork and lacking regulatory deadlines, we can assist. Nanonets works along with your present techniques to ship actual enhancements with out turning your operation the other way up. Able to see it in motion? Schedule a demo today.