Veryfi is a well-liked OCR device identified for its velocity and accuracy in knowledge extraction.

Whereas its free cell app and API integration make it versatile for a lot of customers, its limitations, equivalent to a 15-page processing cap and strict API price limits, can hinder massive scale doc processing.

For companies needing extra versatile, superior doc processing options, exploring options to Veryfi is crucial.

Stick with us as we discover the very best Veryfi options with OCR capabilities that additionally present velocity, accuracy and extra flexibility.

Fast comparative desk: High Veryfi options

Given the various choices obtainable, selecting the suitable OCR or doc processing device will be overwhelming. That can assist you make an knowledgeable resolution, we’ve compiled a comparative desk of eight in style options to Veryfi.

| S.No. | Title | Spotlight Characteristic | Free Trial | Pricing | High Person Evaluation |

|---|---|---|---|---|---|

| 1 | Veryfi | Fast OCR with minimal handbook intervention for expense and receipt administration. | Sure | Begins at $500/month | Quick processing, however customization choices are restricted. |

| 2 | Xero Hubdoc | Automated knowledge seize from payments and receipts, built-in with Xero. | Sure | Included with Xero Plans | It’s handy for Xero customers however has occasional syncing points. |

| 3 | Zoho Expense | Superior expense administration with auto-scanning and multi-currency help. | Sure | Begins at $4/consumer/month | Nice for managing bills, however setup can take time. |

| 4 | Nanonets | AI-powered OCR with customizable workflows and in-built integration with ERP instruments. | Sure | Begins at $0.3/web page | Excessive OCR accuracy, intuitive interface, and fast setup. |

| 5 | Taggun | Actual-time receipt OCR API centered on velocity and ease. | Sure | $0.08/scan for underneath 5000 scans | Simple API and fast response instances. |

| 6 | Klippa | Actual-time knowledge extraction with a concentrate on safety and GDPR compliance. | Sure | Customized pricing | Person-friendly design and environment friendly processing. |

| 7 | DEXT | Complete expense administration with automated knowledge extraction. | Sure | Begins at ~$230/month | Characteristic-rich however barely overwhelming interface. |

| 8 | Mindee | AI-driven doc parsing with pre-trained fashions for various paperwork. | Sure | Customized pricing | Simple integration and excessive accuracy. |

| 9 | Google Cloud Imaginative and prescient API | Sturdy picture evaluation, together with textual content detection and classification. | Sure | Characteristic-based pricing | Highly effective options however require a studying curve. |

1. Xero Hubdoc

Xero’s Hubdoc is a data capture device that streamlines monetary doc administration by robotically extracting crucial data from payments and receipts. Customers can add paperwork through e mail, cell app, or desktop, and Hubdoc processes these to create transactions in Xero, full with connected supply paperwork.

This integration simplifies reconciliation, reduces handbook knowledge entry, and ensures monetary information are up-to-date and correct.

Who ought to use Xero Hubdoc?

💡

Xero Hubdoc is good for solo merchants, new companies, and self-employed people searching for to automate monetary doc administration and streamline bookkeeping processes.

Options that matter

- Automated knowledge seize: Extracts key particulars from payments and receipts through cell, e mail, or desktop uploads.

- Xero integration: Creates draft transactions in Xero with connected supply paperwork for simple reconciliation.

- Financial institution assertion conversion: Turns PDFs into CSVs for fast import into Xero.

- Safe storage: Organizes paperwork in folders with limitless storage for simple entry.

- Function administration: Assigns consumer roles to regulate entry and guarantee knowledge safety.

Professionals and cons of Xero Hubdoc

| Professionals | Cons |

|---|---|

| Environment friendly knowledge extraction | Occasional sync points |

| Integrates properly with Xero | Studying curve for brand spanking new customers |

| Saves time by automating duties | Restricted customization choices |

| Cell-friendly for on-the-go use | Pricing could also be excessive for small companies |

2. Zoho Expense

Zoho Expense is a complicated expense administration resolution that simplifies and automates monetary workflows. Powered by AI, it streamlines the monitoring, reporting, and enterprise expense approval process for groups and people.

Zoho Expense’s auto-scan function precisely extracts key data from receipts, enabling sooner processing and decreasing handbook errors. It helps multi-currency and multi-language capabilities and provides world scalability for companies of all sizes.

With a user-friendly interface and seamless integration with accounting methods, Zoho Expense empowers finance groups and decision-makers to achieve higher management over spending whereas bettering operational effectivity and decreasing prices.

Who ought to use Zoho expense?

💡

Options that matter

- Receipt auto-scan: Robotically extracts data from receipts to create bills.

- Coverage compliance: Enforces firm expense insurance policies to make sure adherence.

- Multi-level approvals: Configures customized approval workflows for expense reviews.

- Actual-time analytics: Offers insights into spending patterns and traits.

- Cell accessibility: Has a cell receipt scanner app for expense reporting through cell units.

- Bank card integration: Syncs company card transactions for simple reconciliation.

- Per diem administration: Automates each day allowances for enterprise journey.

- Multi-currency help: Handles bills in varied currencies with automated conversion.

- Customizable fields: Tailors expense types to satisfy particular enterprise wants.

- Seamless integrations: Connects with accounting and ERP methods for streamlined operations.

Professionals and cons of Zoho Expense

| Professionals | Cons |

|---|---|

| Person-friendly interface | Restricted integration with some apps |

| Sturdy cell app for expense monitoring | Delays in buyer help |

| Options like auto-scan and approvals | Bank card syncing points reported |

| Aggressive pricing for enterprises | Customization might have a studying curve |

| Common updates with new options | Setup will be time-consuming initially |

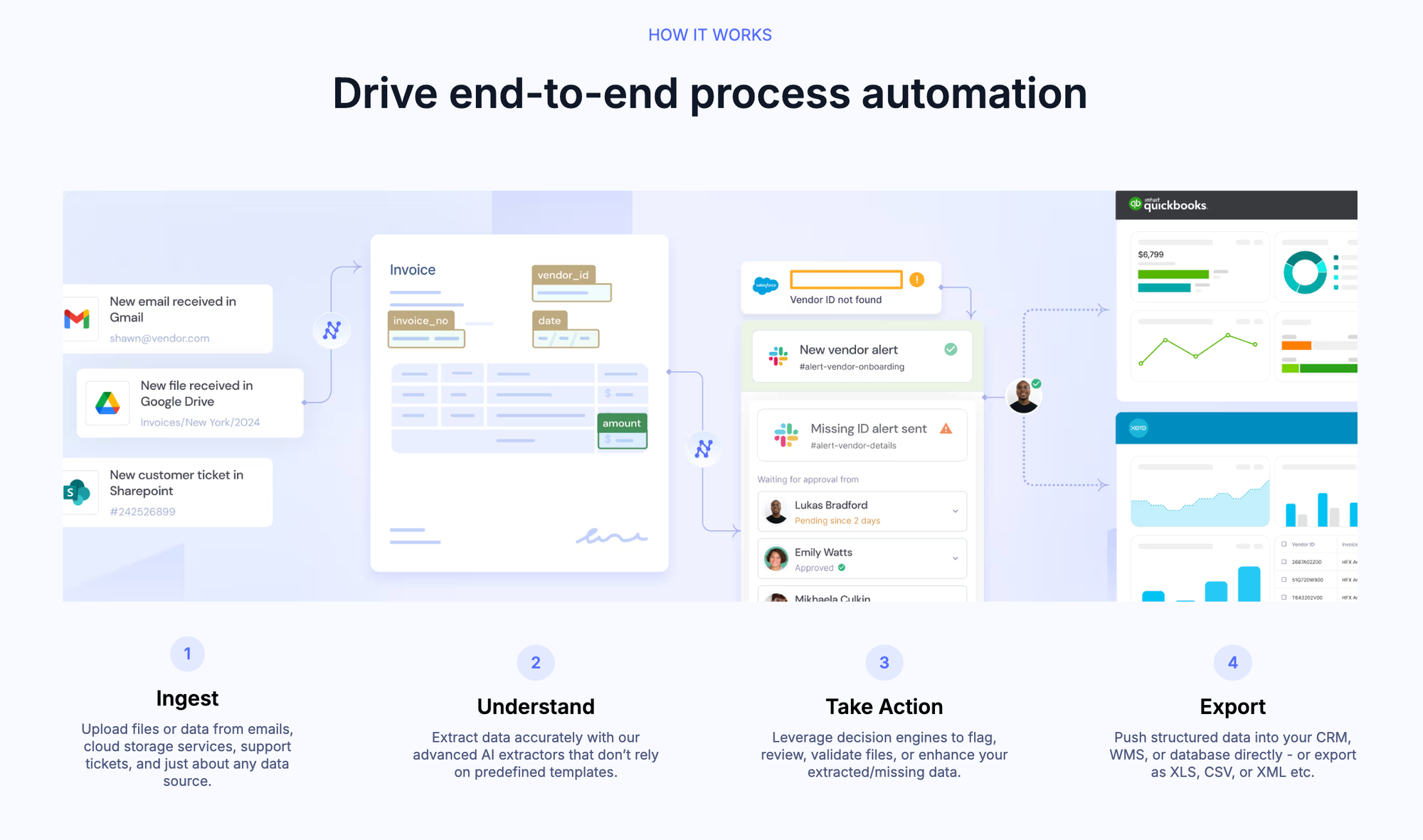

3. Nanonets

Nanonets OCR‘s superior capabilities in automated doc processing permit companies to ingest knowledge from varied doc sorts, together with invoices, receipts, contracts, financial institution statements, IDs, and declare types. This achieves over 90% accuracy throughout the 10M+ month-to-month recordsdata processed globally.

Nanonets helps automate duties like approval workflows, knowledge validation, and matching processes with a user-friendly interface, in depth OCR API integrations, and learnable resolution engines.

It reduces human errors, accelerates turnaround instances (6x sooner), and provides important price financial savings (30%+). Supporting 100+ languages and unmatched semantic understanding, it stands out by enabling zero-training fashions to course of paperwork immediately.

Who ought to use Nanonets?

💡

Nanonets is good for medium to massive companies searching for to automate complicated doc workflows with correct AI fashions and customizable integrations.

Options that matter

- AI-powered automation: Processes structured and unstructured paperwork with 90%+ accuracy.

- Doc help: Handles invoices, receipts, contracts, IDs, and extra.

- Multi-language: Helps 100+ languages, together with Polish and Czech.

- Quick processing: Reduces time per web page from minutes to seconds.

- Value financial savings: Cuts 30%+ on handbook processing prices.

- Export choices: Integrates with CRMs, WMS, databases, or exports as XLS/CSV/XML.

- Scalable: Processes 1000’s of paperwork and automates workflows with out rising staff dimension.

- 24/7 availability: At all times-on AI for steady operations.

- Tailor-made options: Helps claims, onboarding, AP automation, and stock administration.

Professionals and cons of Nanonets OCR

| Professionals | Cons |

|---|---|

| Extremely correct AI fashions eradicate template dependency | Premium pricing for low-volume customers |

| Processes complicated unstructured paperwork | Mannequin coaching requires setup time |

| Superior desk and line recognition | The interface wants extra streamlining |

| Handles poor-quality scans properly | Some options have a studying curve |

| Constructed-in integration with QBO, Xero, Sage, Netsuite |

4. Taggun

Taggun provides a complicated OCR API designed to transform receipts and invoices into structured knowledge effectively. With help for over 85 languages, it processes various codecs, together with pictures and PDFs, making certain excessive accuracy in knowledge extraction.

Taggun’s machine studying fashions deal with varied regional knowledge factors, equivalent to Australian Enterprise Numbers and Brazilian CNPJs, catering to world enterprise wants effectively.

It facilitates seamless integration into functions, enabling real-time receipt scanning and validation.

Who ought to use Taggun?

💡

Taggun is good for mid-sized to massive software program firms, fintech companies, and e-commerce platforms that want real-time, automated, and correct receipt and bill scanning.

Options that matter

- Actual-time processing: Immediately converts receipts and invoices into structured knowledge.

- Multi-language help: Handles over 85 languages for world applicability.

- Versatile file compatibility: Processes varied codecs, together with JPEG, PNG, GIF, and PDF.

- Excessive accuracy: Delivers over 90% accuracy in knowledge extraction.

- Line merchandise extraction: Captures detailed product data from receipts.

- Customizable API: Provides a developer-friendly API for seamless integration.

- Receipt validation: Validates receipts for loyalty packages and fraud detection.

Professionals and cons of Taggun

| Professionals | Cons |

|---|---|

| Simple API integration with clear docs | Occasional inaccuracies in detection |

| Fast and correct OCR processing | Restricted options in lower-tier plans |

| Helps a number of languages globally | Pricing could also be excessive for small companies |

| Responsive buyer help | Slower API response throughout peak instances |

| Versatile pricing for scaling | Superior options want extra setup |

5. Klippa

Klippa makes a speciality of AI-driven doc automation options designed to streamline enterprise processes. Their flagship product, Klippa DocHorizon, provides clever doc processing capabilities, enabling organizations to scan, learn, kind, extract, anonymize, convert, and confirm paperwork at scale.

By integrating superior OCR know-how, Klippa transforms unstructured knowledge into structured codecs, facilitating seamless knowledge administration and decreasing handbook workloads. Dedicated to enhancing operational effectivity, Klippa’s options present instruments that empower companies to attain extra in much less time.

Learn About: Best Alternatives to Klippa

Who ought to use Klippa?

💡

Klippa is most fitted for small companies, particularly these in finance, retail, and logistics. Its cost-effective OCR and doc automation options add worth.

Options that matter

- Doc automation: Scans, reads, kinds, extracts, and verifies paperwork.

- Superior OCR: Extracts knowledge precisely from varied doc sorts.

- Knowledge anonymization: Masks delicate data for compliance.

- Doc verification: Validates authenticity to forestall fraud.

- Id verification: Analyzes paperwork and detects liveness for ID checks.

- API and SDK integrations: Seamlessly connects with current methods.

- Workflow automation: Creates customized processes to streamline duties.

Professionals and cons of Klippa

| Professionals | Cons |

|---|---|

| Correct OCR for knowledge extraction | Restricted customization for templates |

| Intuitive and user-friendly interface | API documentation might be improved |

| Responsive and immediate help | Occasional inaccuracies in OCR outcomes |

| Seamless integration with methods | Pricing could also be excessive for some options |

6. DEXT

Dext is a prime bookkeeping automation supplier. It helps companies, accountants, and bookkeepers seize, course of, and handle monetary paperwork effectively.

With seamless integration throughout main accounting software program and over 11,500 monetary establishments worldwide, Dext streamlines workflows by automating knowledge extraction from receipts, invoices, and financial institution statements.

Its platform provides real-time expense monitoring, customizable approvals, and superior analytics for knowledgeable choices. By decreasing handbook entry and errors, Dext boosts productiveness and lets professionals concentrate on progress and consumer service.

Learn About: DEXT Alternatives and Competitors

Who ought to use DEXT?

💡

Dext is good for small to medium-sized companies, accountants, and bookkeepers searching for to automate knowledge entry and streamline monetary workflows. Its options are significantly helpful for professionals aiming to boost effectivity and accuracy in monetary administration.

Options that matter

- Automated knowledge seize: Collects receipts and invoices through cell, e mail, or integrations, eradicating handbook entry.

- Seamless accounting integration: Syncs with main accounting software program and monetary establishments.

- Expense administration: Simplifies reporting and approvals for higher monetary management.

- Actual-time knowledge processing: Immediately digitizes and categorizes monetary paperwork.

- Person-friendly interface: Intuitive design for simple navigation.

- Sturdy safety measures: Ensures knowledge safety and compliance.

- Complete help: Offers in depth assets and help for customers.

Professionals and cons of Dext

| Professionals | Cons |

|---|---|

| Correct knowledge extraction and processing | Superior options require technical experience |

| Seamless integration with accounting instruments | Pricing could also be excessive for small companies |

| Person-friendly and intuitive interface | Restricted cell app performance |

| Streamlines monetary workflows | Buyer help might be improved |

| Sturdy safety and compliance | Lacks flexibility for area of interest integrations |

| Actual-time knowledge processing | Some options have a studying curve |

7. Mindee

Mindee is an AI-powered platform that automates doc processing, changing unstructured knowledge into actionable insights with over 90% accuracy. It handles a variety of paperwork, together with invoices, receipts, contracts, and IDs, processing thousands and thousands of recordsdata month-to-month.

With a user-friendly interface and superior resolution engines, Mindee accelerates workflows, reduces errors, and cuts prices by 30%+. Supporting many languages and zero-training fashions, it delivers fast outcomes.

Who ought to use Mindee?

💡

Mindee is greatest fitted to medium to massive enterprises and software program distributors the place superior doc processing is crucial to optimizing operations and decreasing handbook workflows.

Options that matter

- AI-powered knowledge extraction: Precisely captures knowledge from varied paperwork, together with invoices, receipts, and IDs.

- Seamless integration: Simply integrates with current methods to streamline doc workflows.

- Customizable options: Provides tailor-made doc processing to satisfy particular enterprise wants.

- Open-source OCR toolkit: Offers docTR, an open-source OCR toolkit for versatile textual content recognition.

- Scalable platform: Handles massive volumes of paperwork effectively, appropriate for companies of all sizes.

- Person-friendly interface: Options an intuitive design for simple navigation and operation.

- Sturdy safety measures: Ensures knowledge safety and compliance with business requirements.

- Complete documentation: Provides in depth assets and help for builders and customers.

Professionals and cons of Mindee

| Professionals | Cons |

|---|---|

| Correct knowledge extraction | Superior options want experience |

| Seamless system integration | Restricted language help |

| Customizable for enterprise wants | Pricing particulars unclear |

| Scalable for prime volumes | No cell app for on-the-go use |

| Person-friendly interface | Restricted buyer help particulars |

| Sturdy knowledge safety | Additional improvement for area of interest methods |

8. Google Cloud Imaginative and prescient API

Google Cloud Vision API allows builders to combine superior picture evaluation capabilities into their functions. It makes use of Google’s machine studying fashions to supply options equivalent to picture labeling, OCR, face and landmark detection, and express content material tagging.

The API helps a variety of picture codecs and might course of pictures saved in varied areas, together with Google Cloud Storage and the net. Google Cloud Imaginative and prescient API simplifies the event course of, permitting companies to effectively derive actionable insights from visible knowledge.

Who ought to use Google Cloud Imaginative and prescient API?

💡

Google Cloud Imaginative and prescient API is good for builders searching for to include superior picture evaluation into their functions with out in depth machine studying experience.

Options that matter

- Picture labeling: Identifies objects and entities in pictures with descriptive labels.

- OCR: Extracts text from images, together with help for handwriting and a number of languages.

- Face detection: Detects human faces, recognizing feelings and facial landmarks.

- Landmark detection: Identifies well-known landmarks and offers geographic coordinates.

- Emblem detection: Acknowledges model logos inside pictures.

- Express content material detection: Flags inappropriate or delicate content material for moderation.

- Picture properties evaluation: Analyzes picture attributes, together with dominant colours and composition.

- Object localization: Detects a number of objects in pictures and offers bounding containers and labels.

Professionals and cons of Google Cloud Imaginative and prescient API

| Professionals | Cons |

|---|---|

| Excessive accuracy in picture recognition | Premium pricing for high-volume utilization |

| Simple integration with current functions | Restricted customization for particular use instances |

| Helps a number of languages for textual content extraction | Occasional inaccuracies with low-quality pictures |

| Complete documentation and help assets | Requires web connectivity for API entry |

| Sturdy options embody OCR, face detection, and object localization | Studying curve for customers with out prior expertise |

About Veryfi

Veryfi addresses effectivity in knowledge processing by providing superior OCR know-how that transforms unstructured paperwork into structured, actionable knowledge. The AI-powered resolution automates the extraction of data from invoices, receipts, checks, and extra, enabling seamless integration into varied functions.

💡

Small accounting companies and bookkeepers desire Veryfi for its user-friendly cell app and environment friendly API setup.

Options that matter

- AI-powered OCR: Robotically extracts knowledge from receipts and invoices with excessive precision.

- Actual-time processing: Offers instantaneous entry to structured knowledge.

- World compatibility: Helps 90+ currencies and 39 languages.

- Safe compliance: Meets SOC 2, GDPR, and HIPAA requirements.

- Seamless integrations: Connects with instruments like QuickBooks and Xero.

- Cell seize: Provides high-quality knowledge seize through smartphones.

- Developer APIs: Provides APIs and SDKs for simple system integration.

- Expense administration: Person-friendly app for monitoring bills on the go

Professionals and cons of Veryfi

| Professionals | Cons |

|---|---|

| Quick and correct OCR | Costly for small companies |

| Intuitive interface | Occasional OCR errors |

| Works properly with accounting instruments | Delays in buyer help |

| Handle bills on the go | Superior options solely in greater plans |

Why select Nanonets AI over Veryfi?

Nanonets stands out with its superior AI capabilities, superior customizability, and broader help for varied doc sorts. Whereas this may seem to be a common assertion, there are a number of particular the reason why many customers desire Nanonets’ superior AI-enabled OCR.

💡

– M. Aflah PT, Solusi Aplikasi (Indonesia)

Some arguments in favor of Nanonets

Named by G2 as a global OCR leader, Nanonets provides distinctive OCR accuracy, buyer help, and workflow automation efficiency. Nanonets additionally stands out because the trusted selection of Fortune 500 firms worldwide.

- Its strong AI engine stands out, with a 95%+ subject and line merchandise extraction accuracy whereas studying to exactly deal with various use instances and constantly bettering.

- Its enhanced software program interoperability reduces setup time, and it comes with built-in 30+ integration choices with all main ERP and accounting instruments (Xero, Quickbooks On-line, Sage, Oracle Netsuite, and many others.).

- Nanonets processes recordsdata in seconds, presenting knowledge in customizable checklist views and a number of export choices with rule-based alerts for quick consideration and verification.

- With a quick implementation, consideration to every buyer’s distinctive wants for personalization, and efficient buyer help, Nanonets stands out as a must have in your tech stack.

Nanonets vs Veryfi OCR

| Metric | Nanonets | Veryfi |

|---|---|---|

| Integration Help | Intensive | Restricted |

| Language Help | 100+ | Restricted |

| Customization | Excessive | Average |

| AI Mannequin Coaching | Sure (with AI confidence scores) | No |

| On-Premise Deployment | Obtainable | Not Obtainable |

| Devoted Account Supervisor | Sure | No |

| White-Labeled UI | Sure | No |

| Doc use instances | 300+ paperwork | Receipts and bills majorly |

| OCR knowledge seize | 95%+ accuracy with AI | …. |

Steadily Requested Questions (FAQs) about Veryfi

Veryfi automates monetary doc processing utilizing superior OCR. It extracts knowledge from receipts and invoices, integrates with accounting software program, and offers real-time expense monitoring to eradicate handbook knowledge entry.

What are some in style options to Veryfi?

Alternate options to Veryfi embody Nanonets, Klippa, Xero Hubdoc, Google Cloud Imaginative and prescient API, ABBYY, and Dext. These instruments provide options like superior OCR, expense monitoring, and integration with accounting methods.

Which Veryfi different is greatest for small companies?

Zoho Expense and Dext are nice for small companies attributable to their ease of use, reasonably priced pricing, and adaptability in managing bills and invoices.

How does Nanonets evaluate to Veryfi?

Nanonets excels with its AI-driven OCR, multi-language help, and the power to course of unstructured knowledge, making it extra versatile than Veryfi.

Are Veryfi options simple to combine with accounting device?

Sure, most options, equivalent to Klippa, Xero Hubdoc, and Nanonets, present seamless integration with CRMs, accounting instruments, and APIs, making certain easy workflows.

Veryfi vs. Hubdoc vs. DEXT: Who is healthier?

Select primarily based in your particular enterprise wants:

- Veryfi: Greatest for fast, automated knowledge extraction.

- Hubdoc: Very best for Xero and QuickBooks customers.

- DEXT: Complete for detailed expense administration.