In recent times, know-how and knowledge evaluation have revolutionized the monetary markets, and using synthetic intelligence in buying and selling has develop into more and more in style. Probably the most fundamental instruments for creating an automatic buying and selling system is utilizing synthetic neural networks (ANN). On this article, I’ll stroll you thru how I applied a easy neural community mannequin for inventory buying and selling utilizing Backtrader — a Python library for backtesting buying and selling methods.

The objective of this undertaking was to construct an automated buying and selling system that makes use of a neural community mannequin to investigate historic buying and selling knowledge and predict whether or not the worth of a monetary asset will go up or down over a particular time interval. Moreover, this mannequin makes purchase or promote choices based mostly on its predictions.

For this undertaking, I selected the next instruments and libraries:

- Backtrader: A Python library that lets you construct, check, and implement buying and selling methods.

- TensorFlow and Keras: To construct and prepare the neural community.

Backtrader helps us construct buying and selling methods and check them on historic knowledge, whereas TensorFlow/Keras are used to create the neural community that can predict the path of the asset’s worth.

The info used to coach the neural community was taken from a monetary market, and every line within the dataset comprises the next data:

- Date and time (e.g.,

2025-03-06 14:30:00) - Opening worth (

Open) - Excessive worth (

Excessive) - Low worth (

Low) - Closing worth (

Shut) - Quantity traded (

Quantity)

This knowledge is important for market evaluation and for constructing a mannequin that may predict market actions based mostly on earlier worth motion.

The neural community I constructed is kind of easy, consisting of a number of dense layers with ReLU and Tanh activation capabilities to foretell market path.

class ANNStrategy(bt.Technique):

def __init__(self):

self.mannequin = self.build_model()

self.data_list = []def build_model(self):

mannequin = Sequential([

Dense(64, activation='relu', input_shape=(5,)),

Dense(32, activation='relu'),

Dense(1, activation='tanh')

])

mannequin.compile(optimizer='adam', loss='mse')

return mannequin

On this neural community:

- The enter is a vector consisting of 5 options:

- The closing worth and quantity for the final 3 durations.

- The output is a price between -1 and 1, indicating the market prediction:

- A constructive worth indicators a purchase advice.

- A adverse worth indicators a promote advice.

To coach the neural community, I used historic buying and selling knowledge. At every step, I used the final 3 durations of knowledge to create an enter vector for the community. The mannequin was then skilled on the entire dataset to regulate its parameters and make extra correct predictions.

if len(self.data_list) > 100:

X_train = np.array(self.data_list[:-1])

y_train = np.array([1 if f[2] > f[4] else -1 for f in self.data_list[1:]])

self.mannequin.match(X_train, y_train, epochs=5, verbose=0)

Because the neural community makes predictions concerning the market’s actions, our algorithm decides whether or not to purchase or promote an asset based mostly on these predictions. The choice-making course of seems one thing like this:

prediction = self.mannequin.predict(np.array([features]))[0][0]

if prediction > 0.5:

self.purchase()

elif prediction self.promote()

If the mannequin predicts a worth improve (i.e., a price higher than 0.5), it’s going to purchase the asset. If the mannequin predicts a worth lower (i.e., a price lower than -0.5), it’s going to promote the asset.

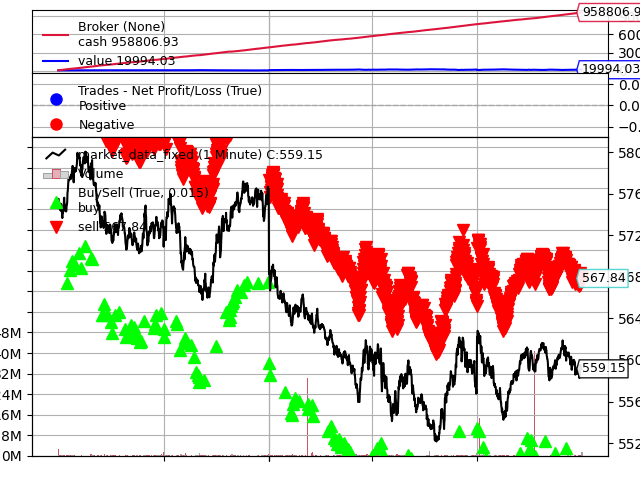

As soon as the neural community and buying and selling technique have been applied, I ran the backtest utilizing Backtrader. This allowed me to simulate how the buying and selling technique would carry out on historic knowledge with out risking actual cash.

cerebro = bt.Cerebro()

knowledge = bt.feeds.GenericCSVData(

dataname="market_data.csv",

dtformat="%Y-%m-%d %H:%M:%S", # Guarantee appropriate date format

timeframe=bt.TimeFrame.Minutes,

compression=1,

openinterest=-1 # Set to -1 in case your dataset doesn’t have this column

)

cerebro.adddata(knowledge)

cerebro.addstrategy(ANNStrategy)

cerebro.run()

cerebro.plot()

This may show the outcomes of the backtest and plot the efficiency of the technique, permitting you to evaluate how properly the mannequin would have carried out previously.

Constructing a inventory buying and selling mannequin utilizing synthetic neural networks (ANN) with Backtrader has been an thrilling journey into the world of algorithmic buying and selling. By leveraging the facility of deep studying, I used to be in a position to create a system able to analyzing historic worth knowledge and making buying and selling choices robotically.

This undertaking is only the start. With extra superior methods and bigger datasets, I plan to proceed enhancing the mannequin, including extra options (e.g., technical indicators) and optimizing the structure for higher efficiency. Sooner or later, I hope to discover completely different fashions, akin to recurrent neural networks (RNN), which may very well be notably efficient for time sequence forecasting in buying and selling.

Should you’re keen on monetary markets and machine studying, this undertaking gives an excellent introduction to the world of algorithmic buying and selling. Joyful coding!