Within the age of digital transformation, the banking sector is present process a big evolution. Because the monetary trade turns into extra data-driven, the adoption of cloud applied sciences has emerged as a game-changer in how monetary establishments function, analyze knowledge, and make selections. Cloud-driven monetary analytics not solely improves operational effectivity but additionally enhances decision-making, enabling banks to remain aggressive, innovate sooner, and supply extra customized providers to prospects. This text explores the impression of cloud-driven monetary analytics on banking and the way it revolutionizes decision-making within the trade.

EQ.1 Price Effectivity in Cloud Computing

Cloud computing has develop into a cornerstone of contemporary monetary providers. Historically, banks relied on on-premises knowledge facilities to retailer and course of giant volumes of knowledge. Nonetheless, these legacy methods had been costly to take care of, restricted in scalability, and infrequently hindered the velocity and agility required in at present’s fast-paced monetary panorama. The rise of cloud applied sciences has reworked this mannequin by providing scalable, cost-effective, and versatile options that enable banks to retailer, course of, and analyze knowledge extra effectively.

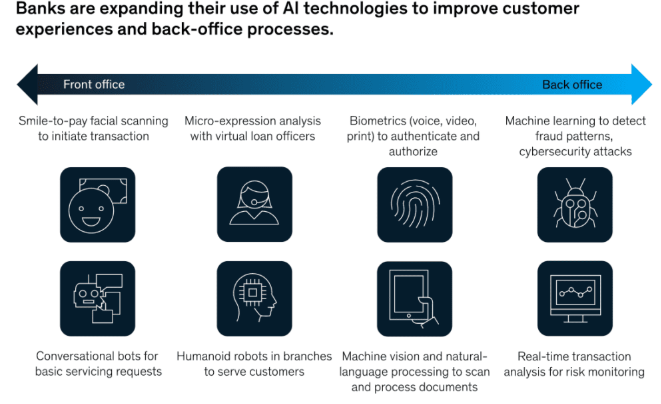

With cloud platforms akin to Amazon Net Companies (AWS), Microsoft Azure, and Google Cloud, banks now have entry to huge computing energy, superior analytics instruments, and synthetic intelligence (AI) capabilities with out the necessity for giant, on-site infrastructure. The cloud supplies an setting the place banks can leverage superior applied sciences to unlock insights from their knowledge, offering them with a aggressive benefit and higher decision-making capabilities.

Scalability and Flexibility

One of many main benefits of cloud-driven monetary analytics is its scalability. Conventional methods typically wrestle to handle the rising quantity of knowledge generated by prospects and transactions. With cloud platforms, banks can scale their infrastructure up or down primarily based on demand, making certain they’ll deal with fluctuations in knowledge quantity with out important price will increase.

For instance, in periods of excessive buying and selling exercise or market volatility, the cloud can accommodate the sudden surge in knowledge processing wants, making certain banks can proceed their operations easily. This scalability permits banks to optimize their assets effectively, lowering infrastructure prices and enhancing monetary administration.

Actual-Time Analytics for Higher Resolution-Making

Within the fast-paced world of banking, selections should be made rapidly. Cloud-driven monetary analytics permits real-time knowledge processing, which is essential for decision-making. Banks can analyze buyer transactions, market traits, and monetary experiences in actual time, permitting them to determine rising dangers and alternatives extra rapidly.

As an example, a financial institution can use real-time analytics to detect fraudulent actions by analyzing transaction patterns and evaluating them to historic knowledge. This real-time method permits banks to take fast motion, lowering the potential for losses and defending each the financial institution and its prospects from fraud.

Improved Danger Administration

Monetary establishments are inherently uncovered to varied dangers, together with credit score threat, market threat, operational threat, and liquidity threat. Conventional threat administration approaches typically depend on historic knowledge and sophisticated fashions, which can not totally seize the dynamic nature of economic markets.

Cloud-driven monetary analytics, powered by AI and machine studying, permits banks to undertake extra subtle threat administration methods. These applied sciences can analyze huge quantities of knowledge from a number of sources, together with market knowledge, financial indicators, and social media, to foretell potential dangers and advocate mitigation methods. This predictive functionality helps banks make extra knowledgeable selections about lending, investments, and market publicity, finally lowering threat.

Enhanced Personalization of Buyer Companies

As prospects demand extra customized banking experiences, monetary establishments are turning to knowledge analytics to tailor their choices. Cloud-driven analytics permits banks to realize a 360-degree view of their prospects by integrating knowledge from a number of touchpoints, together with transaction histories, on-line habits, and social media interactions.

By analyzing this knowledge, banks can supply customized monetary merchandise, funding recommendation, and mortgage suggestions that meet the precise wants of every buyer. For instance, a financial institution can use knowledge analytics to supply personalized financial savings plans or alert prospects to funding alternatives primarily based on their monetary objectives and preferences. This degree of personalization not solely enhances the client expertise but additionally strengthens buyer loyalty.

Price Effectivity

The shift to cloud computing considerably reduces the price of sustaining and upgrading on-premises infrastructure. As a substitute of investing in costly {hardware} and IT workers to handle knowledge facilities, banks will pay for cloud providers on a subscription foundation. This pay-as-you-go mannequin permits banks to entry cutting-edge analytics instruments and storage capabilities with out the upfront capital expenditure.

Furthermore, cloud platforms supply computerized software program updates and safety patches, making certain that banks are at all times utilizing the newest applied sciences with out extra prices. This price effectivity makes cloud-driven monetary analytics accessible to a variety of economic establishments, from giant banks to smaller neighborhood banks and credit score unions.

Collaboration and Knowledge Sharing

Collaboration is crucial in at present’s interconnected monetary ecosystem. Cloud platforms present safe, centralized environments the place completely different departments inside a financial institution can share knowledge and insights seamlessly. This collaborative method helps get rid of knowledge silos, making certain that each one stakeholders, from threat managers to monetary analysts, have entry to the identical data.

Moreover, cloud-driven analytics can help collaboration throughout banks and third-party companions, akin to fintech firms, regulatory our bodies, and auditors. This allows a extra environment friendly trade of knowledge and fosters innovation, finally main to higher decision-making and extra sturdy monetary services and products.

A number of banks and monetary establishments have already harnessed the ability of cloud-driven monetary analytics to enhance their operations and decision-making processes.

Fraud Detection

A serious financial institution used cloud-powered AI fashions to detect and forestall fraudulent actions in real-time. By analyzing patterns in transaction knowledge and leveraging machine studying, the financial institution was capable of determine suspicious actions with higher accuracy and velocity, lowering fraudulent transactions by over 30%.

Credit score Danger Evaluation

Cloud-based analytics have additionally revolutionized credit score threat evaluation. Banks now use superior algorithms to evaluate the creditworthiness of debtors by analyzing a wider array of knowledge, together with social media exercise, buying habits, and even cell phone utilization. This data-driven method permits banks to supply loans to a broader vary of shoppers, together with these with restricted credit score histories, whereas managing threat extra successfully.

Regulatory Compliance

Regulatory compliance is a big problem for banks, as they have to adhere to ever-changing guidelines and requirements. Cloud platforms present a centralized hub for monitoring compliance knowledge and reporting to regulators. For instance, a world financial institution leverages cloud-based analytics to streamline its regulatory reporting, lowering the time spent on compliance duties and making certain adherence to native and worldwide rules.

EQ 2.Danger Prediction and Administration Utilizing Analytics

As cloud applied sciences proceed to evolve, so too will their impression on the banking trade. The way forward for cloud-driven monetary analytics in banking is promising, with improvements in AI, blockchain, and quantum computing poised to drive additional developments. Banks that embrace these applied sciences is not going to solely enhance their decision-making capabilities but additionally acquire a aggressive edge available in the market.

In conclusion, cloud-driven monetary analytics is reshaping the banking trade by offering highly effective instruments for real-time knowledge processing, improved threat administration, customized providers, and price effectivity. As monetary establishments more and more depend on cloud-based platforms to reinforce decision-making, those who undertake these applied sciences early might be greatest positioned to thrive within the quickly evolving monetary panorama.