1. Introduction

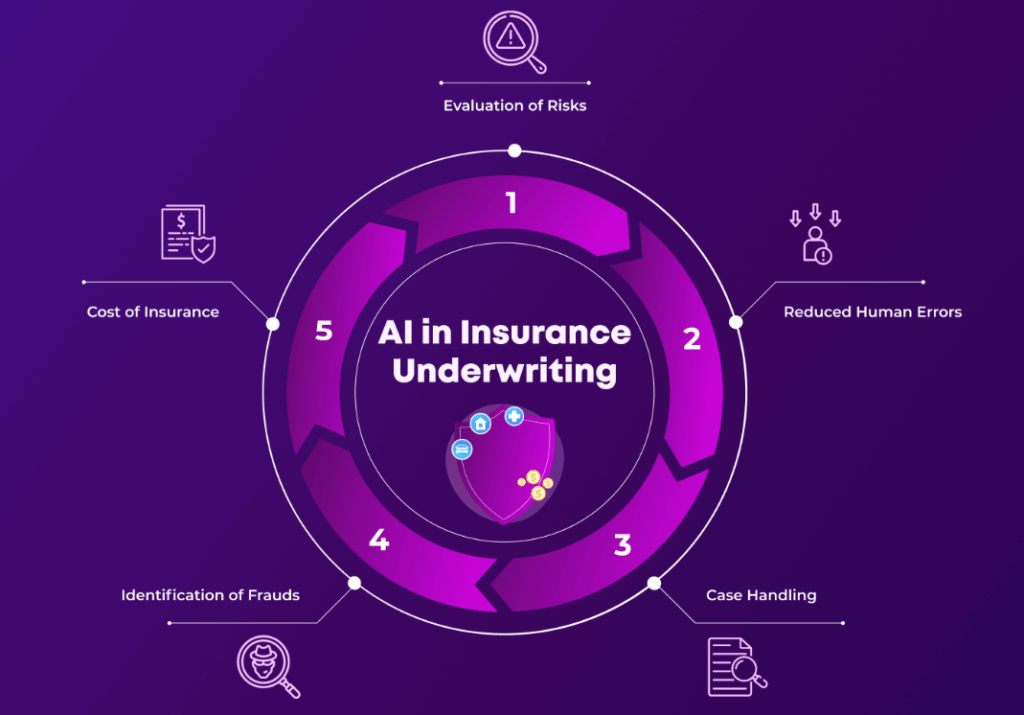

The insurance coverage business is more and more integrating machine studying (ML) to enhance the effectivity, accuracy, and scalability of underwriting processes. Underwriting, which entails assessing the danger related to insuring an individual or entity, has historically relied on actuarial fashions and professional judgment. The usage of ML permits insurers to course of huge datasets and uncover advanced patterns, enabling extra refined threat predictions. Nevertheless, as ML fashions turn out to be extra opaque and complicated, stakeholders — regulators, underwriters, and prospects — demand higher transparency. This demand has led to the emergence of Explainable Synthetic Intelligence (XAI), which goals to make ML fashions and their selections comprehensible to people. Within the context of insurance coverage underwriting, XAI performs a essential function in enhancing belief, accountability, and equity.

Eq.1.Function Attribution utilizing SHAP Values

2. The Want for Explainability in Underwriting

Insurance coverage underwriting entails high-stakes selections that have an effect on particular person lives and monetary well-being. ML fashions utilized in underwriting could decide eligibility, pricing, and protection, however their complexity typically ends in a “black field” phenomenon, the place determination logic will not be simply interpretable. This opacity creates a number of challenges:+p

- Regulatory Compliance: Regulatory our bodies in lots of jurisdictions require insurers to clarify underwriting selections to make sure non-discrimination and equity.

- Buyer Belief: Policyholders could also be cautious of automated selections except supplied with clear and comprehensible reasoning.

- Underwriter Confidence: Human underwriters want to grasp and validate ML mannequin outputs to make sure they align with area data and moral requirements.

3. Explainable AI Methods in Underwriting

XAI strategies may be categorized into model-specific and model-agnostic methods. Each sorts are relevant to insurance coverage underwriting, relying on the ML fashions used and the extent of clarification required.

- Function Significance: Instruments like SHAP (SHapley Additive exPlanations) and LIME (Native Interpretable Mannequin-Agnostic Explanations) present perception into how options contribute to a particular determination. For instance, a SHAP evaluation would possibly reveal {that a} greater Physique Mass Index (BMI) considerably impacts life insurance coverage premiums.

- Surrogate Fashions: Easy, interpretable fashions (like determination timber) may be skilled to approximate the conduct of extra advanced fashions, providing a high-level overview of determination logic.

- Counterfactual Explanations: These present what minimal modifications to enter knowledge would alter a mannequin’s determination. For example, explaining that if an applicant’s credit score rating had been 20 factors greater, they might qualify for a decrease premium.

- Visible Explanations: For sure varieties of knowledge, like medical photographs utilized in well being underwriting, visible clarification methods (e.g., Grad-CAM) can spotlight areas contributing to a call.

4. Enhancing Belief by way of XAI

XAI fosters belief in ML-based underwriting by providing transparency at a number of ranges:

- Operational Transparency: Underwriters can see how a mannequin arrived at its conclusion, making it simpler to justify selections and detect errors or biases.

- Moral Assurance: By making bias or disparate affect extra seen, XAI can help equity audits and promote equitable therapy throughout demographic teams.

- Buyer Engagement: Offering prospects with explanations can demystify selections and cut back perceptions of arbitrariness, enhancing satisfaction and loyalty.

5. Challenges in Implementing XAI in Underwriting

Regardless of its potential, integrating XAI in underwriting poses a number of challenges:+

- Complexity of Explanations: The technical nature of some XAI strategies could make them troublesome to interpret by non-expert stakeholders.

- Commerce-off with Mannequin Efficiency: Extra interpretable fashions typically come at the price of diminished accuracy in comparison with black-box fashions.

- Information Privateness and Safety: Offering detailed explanations could threat exposing delicate knowledge or proprietary mannequin logic.

- Dynamic Laws: As regulatory expectations evolve, insurers should repeatedly adapt their XAI practices to stay compliant.

Eq.2.Native Interpretable Mannequin-Agnostic Explanations (LIME)

6. Future Instructions

The way forward for XAI in underwriting lies within the growth of extra intuitive and user-friendly clarification instruments tailor-made to completely different stakeholders. Analysis ought to concentrate on hybrid programs that mix human experience with AI-driven suggestions, permitting underwriters to override or refine selections primarily based on contextual data. Moreover, requirements for explainability in insurance coverage should be developed in collaboration with regulators, insurers, and technologists to make sure consistency and equity.

Developments in causal inference and fairness-aware ML additionally maintain promise. These methods can present not simply explanations but in addition insights into potential interventions to mitigate threat or enhance equity. For example, an insurer may not solely clarify why a coverage was denied but in addition recommend actions the applicant may take to qualify sooner or later.

7. Conclusion

Explainable AI is essential for the accountable and efficient integration of machine studying in insurance coverage underwriting. By enhancing transparency, fostering belief, and supporting regulatory compliance, XAI bridges the hole between advanced fashions and human understanding. Because the insurance coverage business continues its digital transformation, embracing XAI will likely be important for sustaining moral requirements and public confidence in automated decision-making programs.