The largest problem on this evaluation is amassing knowledge from addresses that offered their tokens. To realize this, we depend on staking protocols that agree to supply anonymized entry and exit knowledge, in addition to transfers to centralized exchanges (CEX). One other problem was figuring out the magnitude of gross sales relative to the initially locked bag.

This mannequin continues to be in draft kind, and all contributions or options for enchancment are vastly appreciated. The largest problem on this evaluation is amassing knowledge from addresses that offered their tokens. To realize this, we depend on staking protocols that agree to supply anonymized entry and exit knowledge, in addition to transfers to centralized exchanges (CEX). One other problem was figuring out the magnitude of gross sales relative to the initially locked bag.

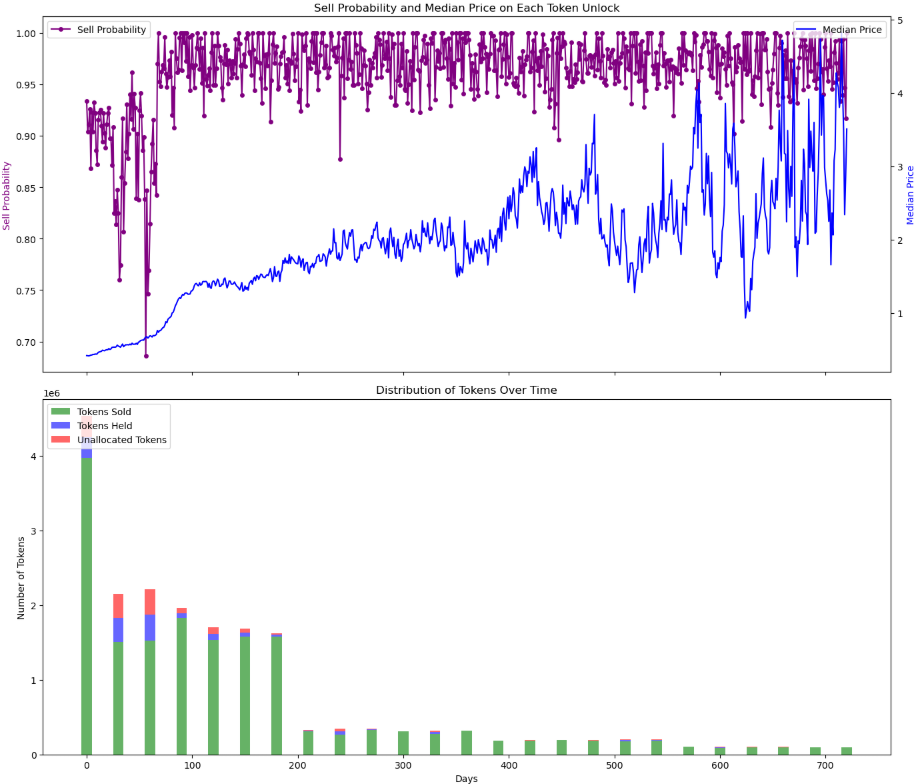

Predicting token sale chances is crucial in tokenomics design, particularly when managing liquidity, staking rewards, and investor expectations. Most present fashions focus both on the Lock-up Interval or ROI independently. Nevertheless, we determined to mix each components to develop a extra complete prediction mannequin. This technique leverages a Random Forest mannequin to evaluate the chance of token gross sales primarily based on these two key components: Dormancy Interval (lock-up period) and Return on Funding (ROI) situations. By analyzing these components, the mannequin supplies insights into potential promoting behaviors and permits higher calibration of vesting and staking mechanisms. Predicting token sale chances is crucial in tokenomics design, particularly when managing liquidity, staking rewards, and investor expectations. This technique leverages a Random Forest mannequin to evaluate the chance of token gross sales primarily based on two key components: Dormancy Interval (lock-up period) and Return on Funding (ROI) situations. By analyzing these components, the mannequin supplies insights into potential promoting behaviors and permits higher calibration of vesting and staking mechanisms.

Why Use a Random Forest Mannequin?

The Random Forest algorithm is especially well-suited for this use case on account of its power in:

- Dealing with Non-Linear Relationships: Token sale habits usually has advanced patterns that Random Forest successfully captures.

- Robustness to Outliers: Dormancy durations and ROI spikes are sometimes risky, and Random Forest mitigates these results by averaging a number of resolution bushes.

- Flexibility in Characteristic Significance: The mannequin permits dynamic weighting of various components corresponding to staking, ROI ranges, and vesting situations.

Key Mannequin Options

The Random Forest mannequin leverages the next options to foretell the likelihood of a token sale:

- Dormancy Interval: Variety of days since vesting or staking started, representing the lock-up interval.

- ROI (Return on Funding): The monetary return noticed relative to the preliminary token worth, influencing promoting choices.

- Staking and Vesting Circumstances: Historic knowledge on staking habits, with components corresponding to lock-in durations, reward schedules, and distribution strategies.

- Market Circumstances: Value volatility and development indicators are additionally included for higher forecasting.

Mannequin Workflow

- Information Preparation

- Extract historic knowledge on token vesting, staking lock up, and ROI primarily based on worth.

- Clear and normalize the info to make sure uniform scale and format.

2.Characteristic Engineering The next engineered options are created to enhance mannequin efficiency:

- Days Since Vesting: Captures the dormancy interval.

- ROI Thresholds: Identifies key ROI factors that set off promoting.

- Token Sale Quantity: Historic quantity knowledge to calibrate market habits.

3.Coaching Course of

- The mannequin is skilled utilizing Random Forest’s ensemble methodology, the place every resolution tree predicts token sale chances.

- Predictions are averaged to generate a ultimate likelihood rating, enhancing stability and lowering variance.

4.Prediction Output

- The ultimate output supplies the likelihood of token sale primarily based on the lock-up interval and ROI situations (and a stochastic worth).

The mannequin’s predictive energy is greatest illustrated by means of sensitivity evaluation. Key insights embrace:

- Influence of Dormancy Interval: As dormancy will increase, token sale likelihood usually drops until ROI spikes considerably.

- Affect of ROI Thresholds: Larger ROI values sharply enhance the chance of gross sales, even for lengthy dormancy durations.

- Staking Period Influence: Prolonged staking durations have a tendency to scale back short-term sale likelihood however might result in a big sell-off as soon as vesting ends.

The Dormancy x ROI mannequin has beneficial functions throughout a number of Web3 situations:

- Liquidity Administration: Predict when giant token gross sales may happen to handle liquidity swimming pools successfully.

- Incentive Calibration: Design staking and vesting mechanisms to align investor habits with mission objectives.

- Investor Technique: Determine high-risk ROI factors the place promote stress is prone to surge.

The Random Forest mannequin provides a strong framework to foretell token sale habits by combining Dormancy Interval and ROI Evaluation. This data-driven strategy permits crypto tasks to make knowledgeable choices concerning token distribution, liquidity planning, and staking methods. By understanding the important thing drivers behind token gross sales, groups can higher anticipate and mitigate dangers in risky markets.